The Ultimate Guide to Client Testimonials for Financial Advisors (2026)

Financial advisors have long existed in an odd world.

Think of how many decisions you make based on Google reviews–from restaurants to hotels to weird Amazon-brand purchases. Reviews and testimonials are the norm in nearly every industry… except for ours.

For an industry where firms live (and die) on referrals, the SEC has long banned advisors from using testimonials. We all know why. Thanks to the worst of the industry, “This is why we can’t have nice things.”

But as of 2020, the SEC has taken a massive step to catch up with modern consumers. Testimonials are now fair game for advisors! Not surprisingly, many advisors are hesitant to be the first to adopt the new rule, especially when there are looming consequences for running afoul.

That being said, harnessing the incredible power of your clients’ stories is worth the work. We’re doing this with our clients, and we’re here to show you how. In this blog, you’ll see:

Compliance Guidelines: Exactly what the SEC requires

Collecting Reviews: Best practices for tactfully collecting client reviews

Marketing Strategy: How to incorporate client testimonials into your marketing channels

Prefer to watch or listen? Check out our webinar with WealthTender!

Creating Trust: The #1 Priority in Financial Advisor Marketing

Word-of-mouth referrals are the heavy incumbent for our industry when it comes to new client acquisition.

Advisors need much more trust to win new business than nearly any other industry.

Any successful marketing can be measured by the amount of trust it can create.

It also doesn’t help that the majority of advisor marketing feels stale, repetitive, and unremarkable. Tell me if this sounds familiar:

“We put your dreams and goals first.”

“We create a personalized plan.”

“We are fiduciaries, meaning we always make recommendations in your best interest.”

“Here’s a picture of my dog.”

Throw a sailboat picture on your website and bam–you're a financial advisor. Is it any wonder advisors are struggling with marketing? We’re all saying the exact same things.

More importantly, anyone (and we mean anyone) can make a promise. You probably know a few advisors making those claims with no track record of backing them up. You’ve probably won a client or two from advisors like that.

How do you prove you can deliver the guidance and service they need? By telling your clients’ stories.

Referrals are powerful because they’re not a sales pitch. You’re not making a promise; your client is sharing their experience.

More so, a critical part of marketing is giving your prospects a mirror to see themselves better–not you.

Yes, they want to know about you, but THEY are the main characters in their stories. What is THEIR pain point? What outcome are THEY pursuing?

Check out this 5 minute recap of our guide to testimonial marketing with WealthTender.

Online Reviews: The Scaleable Referral

For their many great qualities, referrals have prominent limitations. Here are a few we encounter:

Referrals depend on your clients. Referrals require the right context. Many of your clients may not have frequent financial conversations with others, and making a recommendation may feel uncomfortable.

Not all referrals carry the same weight. What happens if the person refers you but they don’t have a strong reputation of their own?

They don’t scale. A referral is a moment in time. Your client shares their story, and then the moment is done. You can’t capture and share that moment.

This is why we are so high on the power of referrals! They capture the power of your clients’ stories, but they also solve the handful of limitations that make referrals unpredictable. For example:

For many clients, providing a review is far more comfortable than finding referral opportunities.

Trust doesn’t depend on a single referrer. Think of restaurants. You’re likelier to pick the 4.5-star option with 100 reviews over the 5.0-star spot with 4 reviews.

Reviews scale. You can share your clients’ testimonials on your website, on social media, in emails, and anywhere else your marketing goes.

They take your clients’ stories and turn them into an asset that you can use across the board. This is big!

If you’ve made it this far, let’s shift from why you should be adopting reviews to how to start compliantly collecting and displaying them.

How to Collect and Display SEC-Compliant Client Testimonials

Unlike many compliance conversations, the testimonial rule is surprisingly straightforward for those who have taken the time to learn it. Its requirements are generally common-sense practices in the consumer's best interest.

Collecting SEC-Compliant Reviews for Financial Advisors

There are two primary rules to consider when planning to collect SEC-compliant reviews.

The first is to avoid cherry-picking.

Cherry picking is what it sounds like – don’t intentionally select certain clients and exclude others based on the likelihood of a good review. While you can still request individual reviews, you need a baseline invitation to all of your clients. We recommend this one of two ways:

Sending a single email blast to your client lists, inviting them to leave a review.

Adding a smaller section to an email newsletter with an invitation to leave a review.

Either way, you need a documented invitation to all of your clients. Once that is done, there are many ways to strategically and contextually ask for client reviews. We’ll get to that below.

The second factor to be aware of is the platform where you request reviews. Google Reviews may be the first example that comes to mind, but platforms like Google or Yelp are NOT compliant with the SEC regarding actively solicited reviews.

There are two ways you can do this (the second one is our recommendation):

The DIY Option: Create an internal form to collect client testimonials. Once collected, you can add the necessary disclaimers and then publish them. You will also need to create a page with every review collected, linked anywhere you share a client testimonial.

WealthTender: WealthTender is the industry’s first and only review platform built for financial advisors. Their platform gives you a simple form to collect client reviews. Once a review comes in, you are notified by email so you can add the necessary disclosures. WealthTender helps ensure you remain compliant with best practices and clean data trails.

How to Display SEC-Compliant Client Reviews for Financial Advisors

Once collected, client reviews can be displayed on your website, posted on social media, included in email marketing… pretty much anywhere you would be marketing your business.

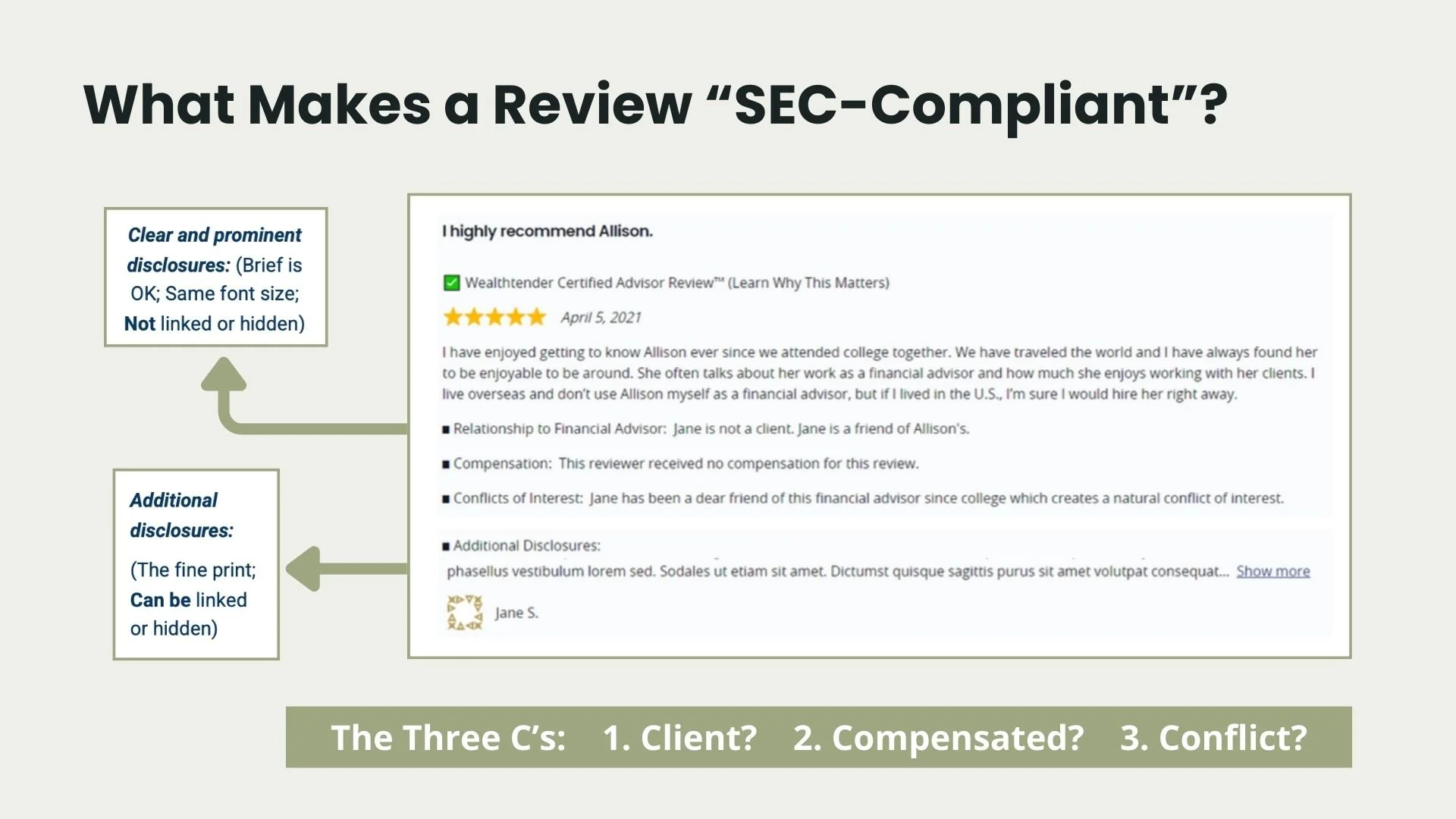

In each case, the SEC requires the same three rules. The easiest way to remember the guidelines is “The Three C’s”. The three factors are:

Client: Is the reviewer a client? Are they current or past? If not a client, what is the relationship?

Compensation: Was the reviewer compensated for leaving a review? (You are allowed to compensate reviewers! More on that below)

Conflict of Interest: Are there any conflicts of interest that the prospect should be aware of?

Client Disclosures

The first factor requires you to disclose your relationship with the reviewer, specifically whether they are clients. Notably, this highlights the fact that you can ask non-clients for reviews!

Consider asking others in your network to leave reviews such as trusted CPAs, estate attorneys, non-profits, or other people who have experience with you professionally.

Compensation Disclosure

The second factor requires you to state whether or not you compensated the reviewer for their testimonial. Similar to the first disclosure, this highlights that you can compensate reviewers!

While compensation is unnecessary, we encourage advisors not to assume paid reviews = sketchy. One creative idea is to give a charitable donation as a thank you for a review.

With a little creativity, disclosing the compensation's nature may help gain more admiration and trust from a prospect!

Conflict Disclosure

The final factor applies primarily to reviewers like COIs who may benefit from your business’ success. For example, if a CPA you refer business to leaves a review, that would need to be disclosed.

Ultimately, each requirement gives readers a sense of context to make their own judgments.

Another important note is that any time you provide a single review or selection of reviews, you must include a link to a full collection of reviews. Again–no cherry-picking!

How to Guide Your Clients for Powerful Reviews

It’s worth noting that to get the most impactful reviews, it helps to give your clients some direction. We do NOT want to taint their honesty; we want to help structure their answer to draw out their story.

You want to capture the problem → solution sequence where prospects can clearly see themselves.

For example, we recommend asking two or three standard questions.

What challenges were you facing when you first chose our firm

How has your experience been with our firm?

In our time together, have there been any other situations where you found our relationship helpful?

One special bonus if you have a niche or specialty: ask a question highlighting your focus. For example–

Has our specialization in executive compensation been of specific value to you?

Did our commitment to values-based investing play a role in you choosing us?

If you can showcase your specialization in client reviews, that is a massive win.

When to Tactfully Ask for Client Reviews

Once you’ve taken care of your cherry-picking safeguard (remember?), you can build testimonial requests into your natural client cadence in many ways. Some methods are set-and-forget, like:

Including a link in your email signature

Building a dedicated page on your website (especially with WealthTender’s widget!)

Adding a consistent section to your newsletter

Creating a print flyer with a QR code in your office

Items like these can be done once and operate smoothly in the background. We recommend any and all of these methods to the extent you’re comfortable with collecting client reviews.

There are also other opportunities to build them into workflows.

For example, you can incorporate a request for testimonials into your client review meetings. These are contextually appropriate either during the review or as part of the follow-up process when your value is top of mind.

Incorporating Client Testimonials Into Your Marketing Strategy

The best way to leverage your testimonials is to consider each review an asset. Once captured, it can be used anywhere with the proper disclosures. Here are a few of the top strategies we implement for our clients:

Adding Reviews to Your Website

In addition to needing a page with all of your reviews for compliance purposes, we tend to choose our top 3-5 reviews to display on your home page or other core pages.

With WealthTender, they provide easy-to-use widgets that allow you to cleanly embed the reviews with all the needed disclosures into your website.

If you specialize in a niche, find reviews that feature your focus and add them to a dedicated page.

Highlighting Reviews on Social Media

Social media is one of the best places to feature reviews! We recommend having a regular cadence of reviews incorporated into your posting. This could look like:

Posting a collection of new reviews once a month.

Posting a single review once per week.

If the review is from a COI, tagging them or doing a collaborative post.

If you want to take this a step further, you can ask certain reviewers to participate in a brief video testimonial! This can be done remotely with all necessary disclosures and links added to a simple branded outro.

We do this for our clients, but you can do this step on your own with a little bit of creativity.

Showcasing Reviews in Email Marketing

We’re big fans of normalizing reviews in your email marketing. Let’s break this into two segments.

Client Communications

Why share reviews with your clients? As part of building trust and winning referrals–we constantly want to be re-inforcing your trustworthiness and competence.

By including a “Client Story of the Week/Month”, you’re tastefully celebrating the impact you’re making. This kind of consistent messaging helps re-affirm that your clients are part of the right community.

Prospect Nurturing

This application is equally powerful. Here, you can be more bold if it fits your personality.

On one hand, you can include reviews as parts of a newsletter.

On the other hand, you can make reviews the focus on an entire email. You can make a bold statement through your clients' experiences.

Critically, most advisors aren’t doing this. This is one of the best ways to stand out in a world full of noisy claims.

Ready to Get Rolling on Client Reviews & Testimonials?

If you’ve made it this far, we’ll just assume you’re bought in on the value of testimonials. The only question now is how you plan to get it done.

At Evergreen, we are permanently bullish on the value of testimonial marketing for financial advisors. For our monthly clients, we offer a 1 time set-up fee (inquire) with our strategic partners at WealthTender. This project includes:

Create your WealthTender profile and branding

Set up your review collection process

Train your team on how to add the correct disclosures for each review

Create your review request strategy for clients and COIs

Create templates from emails to brochures for requesting reviews

As the reviews start rolling in, we also ensure they consistently appear in your content marketing on your website, social media, and email communications.

This service is only available to our monthly clients as we are big believers in the value of a comprehensive marketing strategy. An asset is only an asset apart from how it is leveraged!

So if you’re interested in working with Evergreen to create a standout advisor brand that captures your clients’ best stories, drop us a line!